Share

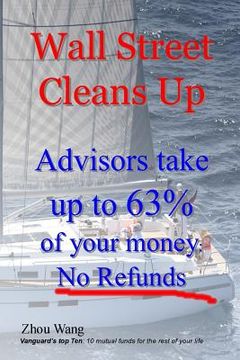

Wall Street Cleans Up: Advisors take up to 63% of your money: No Refunds! (in English)

Zhou Wang

(Author)

·

Createspace Independent Publishing Platform

· Paperback

Wall Street Cleans Up: Advisors take up to 63% of your money: No Refunds! (in English) - Wang, Zhou

$ 10.36

$ 12.95

You save: $ 2.59

Choose the list to add your product or create one New List

✓ Product added successfully to the Wishlist.

Go to My WishlistsIt will be shipped from our warehouse between

Monday, June 24 and

Tuesday, June 25.

You will receive it anywhere in United States between 1 and 3 business days after shipment.

Synopsis "Wall Street Cleans Up: Advisors take up to 63% of your money: No Refunds! (in English)"

How Wall Street takes 63% of your money "... that little 2 percent fee will erode 63 percent of what you would have had." John Bogle, Frontline The average investor earned just 3.79% while a simple non-advisor index fund earned 11% over time. Dalbar.com QAIB "The market is a way to transfer money from the impatient to the patient." Warren Buffett Wall Street must stop "depleting investors retirement savings." Advisers can keep their "conflicted" commissions, but it's time to stop harming clients by depleting their retirement savings, says the chairman of the Labor Department's hearings on its proposed fiduciary rule. "We are absolutely not banning commissions," he says, a day after the hearings concluded. "We just want everyone who is working on retirement accounts to be acting as fiduciaries." Fiduciaries are legally bound to put their clients' best interests before their own when providing financial advice. Will regulators stop Wall Street from cleaning us out? Wall Street is really about separating people from their money. It is successful for the owners. A broker is a salesman with a median income of $61,555. His/her job is to provide attractive promises that create illusions of wealth-building for you. The owners make millions, with Fidelity's Abby Johnson topping the list at $13 Billions. The odds of you, the average trader or investor becoming wealthy from your "play" are very long. Wall Street pays for Congress's elections so when their schemes fail, we taxpayers give them back what they lost. They can't lose. The big fish never spend time in jail for fraud or "misleading" us! See the list of Multi-Billionaires you have made wealthy on page 61. There are no refunds when they fail.

- 0% (0)

- 0% (0)

- 0% (0)

- 0% (0)

- 0% (0)

All books in our catalog are Original.

The book is written in English.

The binding of this edition is Paperback.

✓ Producto agregado correctamente al carro, Ir a Pagar.